In the ever-evolving landscape of real estate, speculations about market trends and potential crises often dominate headlines. One such concern that has been circulating is the fear of a looming wave of foreclosures in 2024. However, a closer look at historical data reveals a more optimistic picture, suggesting that the housing market may not be on the brink of a massive crisis.

The Great Recession Comparison:

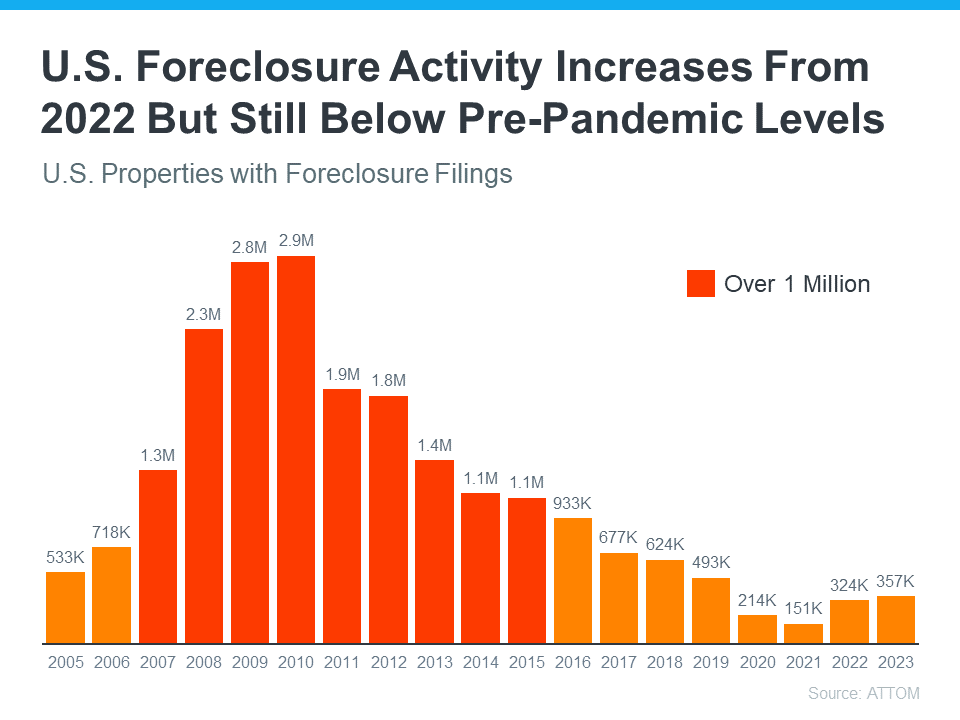

To understand the current situation, it’s essential to draw comparisons with the past, particularly the housing market collapse during the Great Recession of 2008. Back then, a combination of subprime mortgage lending practices and financial market turmoil led to a surge in foreclosures, leaving a lasting impact on the real estate industry.

However, the circumstances today differ significantly from those of 2008. Stringent lending practices have been implemented since the Great Recession, making it harder for individuals to obtain risky subprime loans. Additionally, financial institutions have adopted more robust risk management strategies to prevent a repeat of the housing bubble.

Pandemic-Related Safeguards:

The COVID-19 pandemic posed unprecedented challenges for homeowners, leading to concerns about a potential surge in foreclosures. Governments worldwide, recognizing the unique circumstances, implemented various relief measures to shield homeowners from financial distress. Mortgage forbearance programs and eviction moratoriums have played crucial roles in preventing a sudden influx of foreclosures.

As economies recover and individuals regain financial stability, the likelihood of widespread foreclosures diminishes. Government interventions and support have acted as effective buffers against the economic fallout, helping homeowners weather the storm and avoid mass defaults.

Current Economic Indicators:

Examining current economic indicators provides further reassurance that a foreclosure wave is not imminent. Unemployment rates have steadily decreased, and economic recovery efforts have gained traction. As job markets strengthen and income stability improves, homeowners are better equipped to meet their mortgage obligations, reducing the risk of foreclosure.

Housing Market Resilience:

The housing market has demonstrated remarkable resilience in the face of adversity. Demand for homes remains high, and low-interest rates continue to incentivize buyers. These factors contribute to a stable and flourishing real estate environment, making it less likely for a significant wave of foreclosures to materialize.

Conclusion:

While concerns about a foreclosure wave in 2024 have circulated, a comprehensive analysis of historical data and current economic indicators paints a more optimistic picture. The lessons learned from the Great Recession, coupled with pandemic-related safeguards and the resilience of the housing market, suggest that the specter of mass foreclosures may be unfounded. Homeowners and industry stakeholders can take comfort in the fact that the real estate landscape, fortified by prudent measures and positive economic trends, is positioned to withstand potential challenges.

Read the Original Article Here: Foreclosure Activity Is Still Lower than the Norm