Considering purchasing a home? Chances are, mortgage rates are top of mind. Understanding how they affect your monthly payments is crucial as you plan your move. With recent headlines about rates, sorting through the information can be overwhelming. Here’s a simplified breakdown of what you need to know.

Mortgage Rates in Flux

Rates are currently fluctuating, causing uncertainty. Various factors influence these fluctuations, including the broader economy, job market conditions, inflation rates, Federal Reserve decisions, and geopolitical factors. According to Odeta Kushi, Deputy Chief Economist at First American, factors such as inflation trends and economic indicators play significant roles in rate changes:

“Ongoing inflation deceleration, a slowing economy and even geopolitical uncertainty can contribute to lower mortgage rates. On the other hand, data that signals upside risk to inflation may result in higher rates.”

Seek Professional Guidance

While delving into each factor impacting rates is possible, it can be time-consuming and daunting amidst the moving process. Instead, rely on professionals who navigate market conditions daily. They offer insights into prevailing trends, future projections, and how they affect your specific situation.

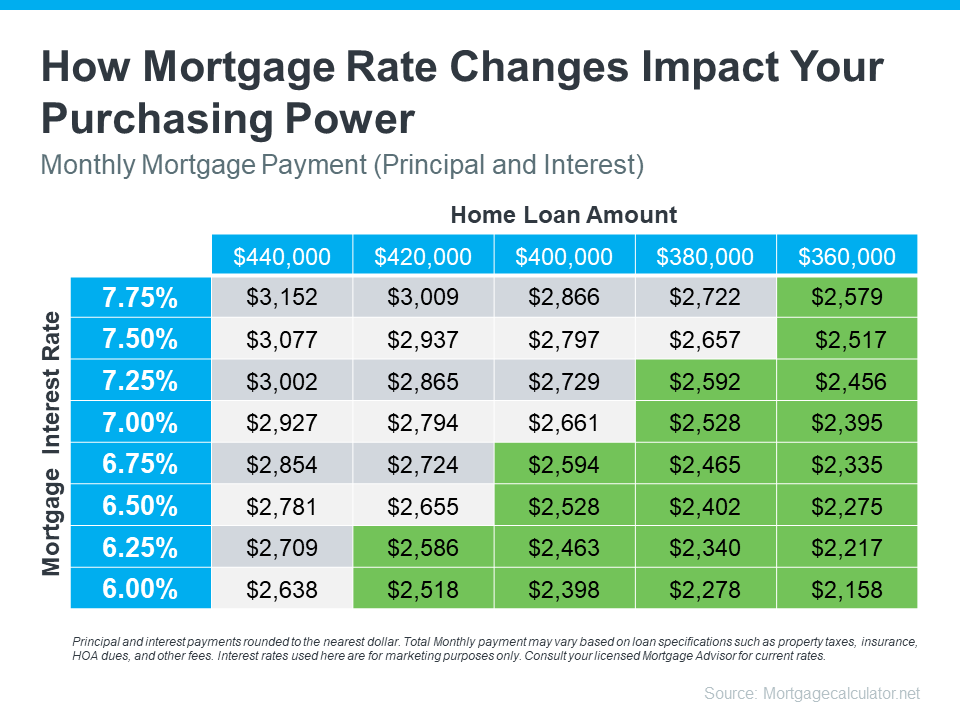

Consider this illustrative chart demonstrating how mortgage rates influence monthly payments for homebuyers. Even slight rate shifts can affect the loan amount within your target budget range.

Visual aids like this simplify complex data, allowing professionals to interpret their implications for you accurately.

Your Guide Through Market Complexity

You don’t need to become an expert in real estate or mortgage rates; you need an expert by your side. Professionals possess the knowledge and skills to interpret market dynamics and guide you effectively.

In Summary

Curious about the current housing market landscape? Let’s connect and decipher its implications for you. With expert guidance, we can navigate the complexities and ensure your move aligns with your financial goals.

Read the Original Article Here: The Best Way To Keep Track of Mortgage Rate Trends