Are you feeling a bit unsure about what’s really happening with mortgage rates? That might be because you’ve heard someone say they’re coming down. But then you read somewhere else that they’re up again. And that may leave you scratching your head and wondering what’s true.

The simplest answer is that what you read or hear will vary based on the time frame they’re looking at. Here’s some information that can help clear up the confusion.

Understanding the Basics:

Mortgage rates are influenced by a multitude of factors, including economic indicators, inflation rates, and the overall health of the housing market. This complexity is why mortgage rates can appear to be on a rollercoaster ride, with ups and downs that might seem contradictory.

Short-Term Fluctuations:

In the short term, mortgage rates can be influenced by various economic events, such as changes in the Federal Reserve’s monetary policy, geopolitical tensions, or unexpected economic data releases. For instance, if the economy shows signs of strengthening, the Federal Reserve might raise interest rates, impacting mortgage rates accordingly. These short-term fluctuations can create the impression that rates are unpredictable.

Long-Term Trends:

On the other hand, looking at long-term trends provides a more stable perspective. Historically, mortgage rates have seen fluctuations, but they tend to follow broader economic patterns. During economic downturns, rates generally drop to stimulate borrowing and spending, while during periods of economic growth, rates may rise to prevent overheating.

Economic Indicators:

To make sense of the mortgage rate puzzle, it’s crucial to keep an eye on key economic indicators. These indicators, such as GDP growth, unemployment rates, and inflation, provide valuable insights into the overall health of the economy and can help anticipate the direction of mortgage rates.

Current Market Conditions:

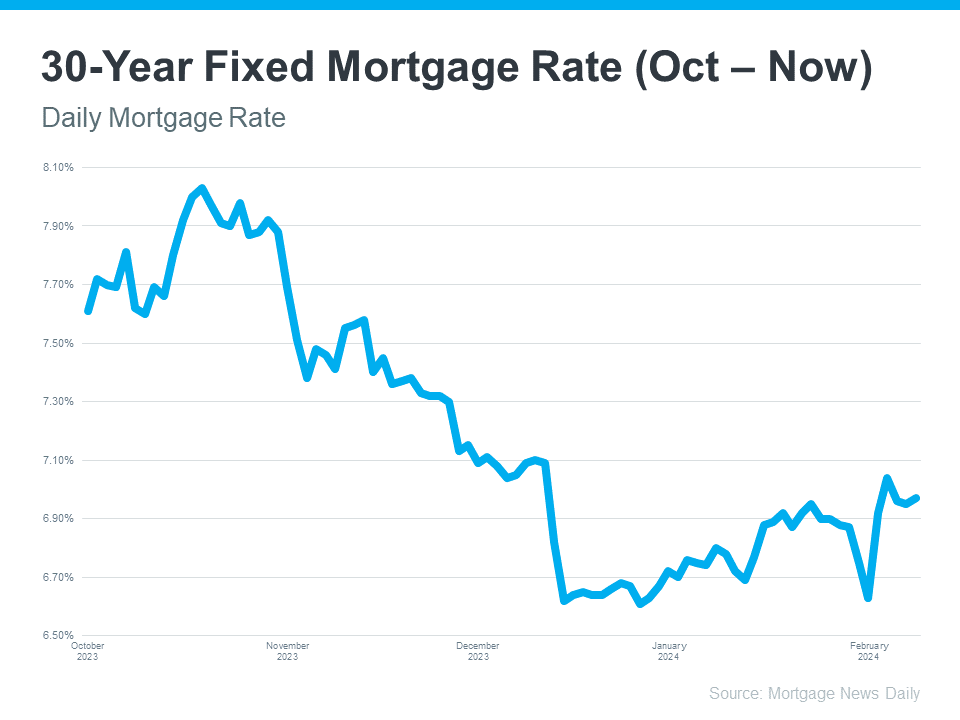

It’s essential to consider the most recent economic data and news to understand the prevailing trends. Consulting with financial experts and mortgage professionals can also provide valuable insights into the current market dynamics. Here’s some great information on rate fluctuations:

Tips for Borrowers:

If you’re in the market for a mortgage or considering a refinance, here are some tips to navigate the uncertainty:

1. Stay Informed: Keep yourself updated on the latest economic indicators and market trends. Regularly check reputable sources for accurate and timely information.

2. Consult Professionals: Reach out to mortgage brokers or financial advisors to get personalized advice based on your financial situation and goals. I have one!

3. Long-Term Planning: Instead of focusing solely on short-term fluctuations, consider your long-term financial goals when making mortgage decisions.

Conclusion:

The world of mortgage rates may seem confusing at times, but understanding the factors influencing their movement can provide clarity. Short-term fluctuations are normal, but a broader view reveals the long-term trends that guide mortgage rates. Stay informed, consult with professionals, and make decisions that align with your financial objectives. By doing so, you can confidently navigate the mortgage rate rollercoaster and make informed choices for your financial future.

Read the Original Article Here: What’s Really Happening with Mortgage Rates?